Premier David Eby’s latest housing announcement ahead of the election has drawn mixed reactions with some realtors expressing doubt about whether the plan to offer “glorified rentals” in the form of long-term leases will address British Columbia’s housing crisis.

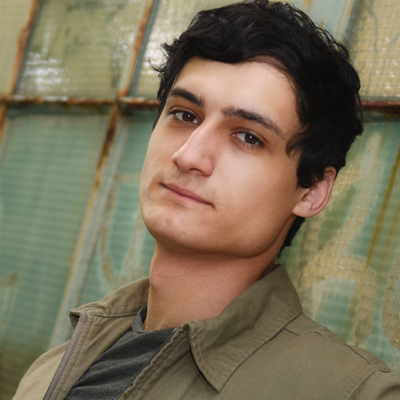

In an interview with True North, Vancouver realtor and housing expert Jay Coupar raised concerns about the pricing and long-term value of the 99-year leasehold homes being billed as a “homeownership dream” by the BC NDP government. Coupar also hosts a YouTube channel where he discusses housing in Canada at length.

The BC government said taxpayers will subsidize 40% of the home’s cost with the stipulation that buyers pay back the financing upon resale of the property or after 25 years of ownership in the form of a second mortgage. The deal was done in partnership with MST Nations, on whose land the homes will be constructed.

The government has priced one-bedroom units in the development at $850,000, with subsidies bringing the cost down to $510,000 for qualifying buyers. Two-bedroom units are priced at $1.3 million, and three-bedrooms at $1.5 million before subsidies. According to Coupar, these prices are too high for a leasehold property, which doesn’t offer the same value as freehold ownership.

“I wouldn’t pay those prices. You can get a good-quality, freehold one-bedroom for mid-$700,000, maybe $800,000 brand new,” said Coupar. “Unless you’re getting a 50% discount, it’s not worth it. The only leasehold I ever sold was for a client whose son was going to UBC. Money wasn’t an issue for him.”

One of the main concerns is the nature of the leasehold agreements, which give buyers ownership of the building but not the land it sits on. The land remains under First Nations ownership for the 99-year lease period.

“It’s a 99-year lease, so you don’t fully own the property,” said Coupar. “I always steer clients away from leaseholds.”

According to Coupar, leaseholds often appreciate more slowly than freehold properties, leading to what Coupar calls a “glorified rental” rather than a long-term investment.

Securing a mortgage for a leasehold property can also be more difficult. Banks typically require larger down payments, and buyers may face additional hurdles when applying for financing.

“It’s tougher. You usually need a larger down payment,” said Coupar. “The issue is that leaseholds don’t appreciate the same way freeholds do. So while they market it as a 40% discount, it’s more like a glorified rental.”

Some have compared the announcement to Singapore’s housing model, where many residents lease their homes. Some NDP supporters have pointed to Singapore as an example of how affordable housing can be managed, but Coupar remains unconvinced.

“I had an interesting comment from an NDP supporter yesterday. They mentioned the Singapore model for affordable housing, but I just had a client return from Singapore, and he said housing is insanely expensive there, even more so than in Vancouver,” said Coupar. “In Singapore, 90% of people lease their homes, and only the ultra-wealthy can afford freehold properties. So, it’s not a silver bullet for affordable housing.”

Additionally, buyers will be burdened with further costs not fully disclosed in the initial announcement by the BC government.

“There will definitely be strata fees. Who knows what it’ll be by the time these developments are completed,” he said.